HME Medical Shop Blog

Your Resource for Home Medical Equipment and Parts

-

Wheelchair Footrest and Leg Rest Guide

Wheelchair Footrest Leg Rest Guide by Drive Medical. Find the Right Foot and Leg rest for Your Drive Medical Wheelchair. -

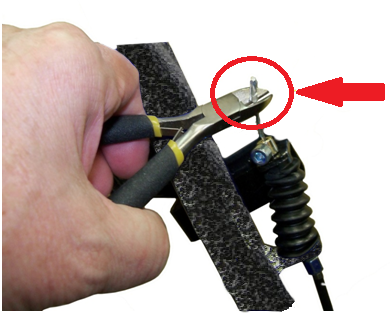

790 Knee Walker Brake Replacement and Installation

Clip the end cover of the cable cover off the cable by the brake. Loosen the cable stop and remove. Remove the boot and spring. Pull the brake cable through the 2 cable guides under the frame of the 790 knee walker. Remove the cable from the tiller cable clip. Pull the outer cable cover back a few inches. Turn... -

How to Install a Wheelchair's Rear Wheel

Learn how to replace the rear wheel on a wheelchair 1. Remove the hub caps from the rear wheel. 2. Remove the rear axle nuts from the rear wheel. 3. Turn the chair on its front side. 4. Remove one of the rear wheel by removing the rear axle. 5. Install the axles into one of the new rear wheels... -

How To Fix a Bellavita Hand Control

Troubleshooting a Bellavita Hand Control and Battery Can Be a Challenge, the Guide below can walk you through. You can view, or if you need to replace the hand control on the this link to a Bellavita Hand Control -

Where Can I Use My FSA Card and HSA Card Online?

Using HSA (Health Savings Account) and FSA (Flexible Savings Account) Cards online can be confusing, but there are a few simple guidelines to know where and on what you can shop online with your card! HSA and FSA cards can only be utilized by approved online retailers. Most will have it noted on the Checkout or About Us page that... -

How to Change Rear Wheel on Nitro Walker Rollator

There are five easy steps to replace the rear wheel on a Nitro Walker Rollator by Drive Medical. Lock the wheel in place Remove the Hub Cap with a Flat End Screw driver or similar tool Use a Socket Wrench (13MM) to remove the Lock-nut from the frame and axle. Release the brake and slide the wheel off. Repeat... -

Mobility Battery Replacement - What You Need To Know

Replacing your Power Mobility Batteries is a great way to breathe new life and the extend the range of your Mobility Scooter or Chair. If you are buying a new battery you will need to follow the steps below (and any in your owners manual) to help find the right one for your mobility scooter or chair. You can... -

Is it Harder for Millennials to Save for Retirement than it was for Baby-Boomers?

A recent article by Alessandra Malito shows that Millennials are running behind on saving for retirement. Not everyone is saving for retirement, they are either living paycheck to paycheck or have no job at all. Many others are not taking advantage of IRAs or other retirement savings accounts. So, this made us ask the question, is it harder for Millennials... -

CareCredit: A Quick and Easy Guide to Quick and Easy Financing Medical Equipment

What is CareCredit? CareCredit is a dedicated credit card for health and beauty expenses* Convenient monthly payments* Quick and easy application process Flexible terms Can use for entire family* Immediate Access* (some limitations may apply) *Subject to credit approval. No application fees, or annual fees mean that you can focus on what is important: your healthcare. (Because there... -

Medicare Reimbursement and Me: A Guide to Filing for Reimbursement

How do I know when to file a claim? When a provider, such as a medical supply company, does not accept a Medicare assignment you will need to begin the process to file a claim for reimbursement. How do I know what will be reimbursed? All claim reimbursement is governed by the set standard Medicare reimbursement rates, even if your...